Welcome to Global Wealth Analytics

True Diversification

LIQUID ALPHA

Providing Crisis Alpha

In 2008, as a highly decorated systematic investment manager, the Global Wealth Analytics (GWA) Global Macro Hedge fund program was ranked #1 in Futures Magazine in the CTAs managing less than 10 million category. Most notably, GWA has managed money for legendary market wizard Larry Hite as well as the highly regarded billion dollar plus ISAM fund. Most recently, GWA received the top performance award from BarclayHedge in 2016 ranking them #1 in the agricultural commodity trader category. BarclayHedge while in our opinion is the leading industry database it should be noted receives it's data on a voluntary basis, is not verified, does not represent the entire industry and the #1 GWA 2016 rankings consists only of agriculture traders. Past performance is not necessarily indicative of future performance. Our trading is speculative and includes a risk of loss.

Delivering cutting edge systematic trading systems to investors and financial advisors with the highest level of integrity, discipline and professionalism possible.

Global Wealth Analytics launched its first Global Macro Hedge fund CTA offering in 2005. GWA's quantitative trading models are based on 20 years of strong research and development of technical trading systems.

Global Wealth Analytics is a quantitative investment system developer that creates fully systematic technical trading systems within a rigorous control environment for investors and financial advisors.

Global Wealth Analytics has managed funds for individual and institutional investors in the US and abroad successfully trading in global markets throughout the United States, Europe and Asia.

Past performance is not necessarily indicative of future performance. Our trading is speculative and includes a risk of loss.

U.S. Air Force Veteran with over 20 years experience conducting quantitative research and system development for investing in global financial markets.

Liquid Alts are a particularly interesting alternative investment strategy because historically they have offered a significant degree of downside protection, especially in declining equity markets.

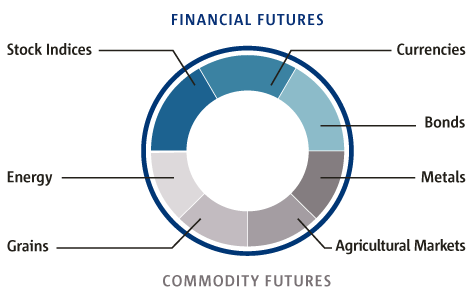

With a historically low or even zero-correlation with stocks, one of the most attractive features of liquid alts is their ability to add broad diversification to an overall investment portfolio. Liquid Alts primarily use standardized etfs or futures and option contracts that trade on highly liquid and strictly regulated stock or futures exchanges worldwide to implement their investment strategies.

Liquid Alts seek absolute returns by taking long and short positions in etfs or options and futures contracts. Past performance is not necessarily indicative of future performance. Our trading is speculative and includes a risk of loss.

Past performance is not necessarily indicative of future performance. Our trading is speculative and includes a risk of loss.

Past performance is not necessarily indicative of future performance. Our trading is speculative and includes a risk of loss.

Past performance is not necessarily indicative of future performance. Our trading is speculative and includes a risk of loss.

Global Wealth Analytics is a proud sponsor of the Shady Tree Foundation. Past performance is not necessarily indicative of future performance.

1042 N. El Camino Real

Suite B-256

Encinitas, CA 92024

Office: 858-354-3786

2016 © Copyright GWA - All right reserved

The enclosed investment development system offerings are available to "qualified eligible persons".The risk of loss in trading etfs, commodities, futures and forex can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in etfs or future trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. In some cases, managed accounts are subject to substantial charges for management and advisory fees. It may be necessary for those accounts that are subject to these charges to make substantial trading profits to avoid depletion or exhaustion of their assets. Please acknowledge your understanding of the above statement and that you are a qualified eligible person by clicking the button below.